In the era of globalization, many countries around the world are fighting for market share in cross boarder trade to gain economy advantage and in most countries international trade represents a significant share of gross domestic product (GDP), an indicator commonly used to measure the economic health of a country, as well as to gauge a country's standard of living.

While cross broader and international trade is rising tremendously hence making the demand of international currencies for trade settlement is also high in demand. Coupled with speculative trading of currencies have somehow made foreign exchange markets very volatile in recent years.

Why currencies volatility has got worse?

In a series of events happened early of the year, FOREIGN-exchange markets are suddenly in turmoil. The Swiss franc jumped by 30% in a matter of minutes last month. Over the past year, the Russian rouble has fallen by 40% against the dollar, while the Canadian and Australian dollar have recently dropped to six-year lows against the greenback. These shifts have proved costly for many in the markets. Alpari, a foreign-exchange broker, went bust, and Everest Capital, a fund manager, had to close its main hedge fund after suffering heavy losses. Why has currency volatility got worse?

Secondly, the sudden drop and falling commodity prices in particular cruel oil are bringing headline inflation rates down and causing economic weakness in some producing countries (such as Russia). This is leading many central banks to cut interest rates; 11 have done so (including the Canadians and Australians) since the start of November. Lower rates diminish the appeal of a currency to yield-seeking international investors. But governments are happy to see their currencies weaken in the current situation, when global economic growth is sluggish and a lower exchange rate might boost the prospects for exports.

So why adding developed foreign currency to your investment portfolio is important?

Many investment experts now advocate and suggest that currencies as the new answer for a truly diversified portfolio.

Currency can play an important role in the overall results delivered by a diversified portfolio. The benefits of holding foreign currency exposures can offers strong diversification benefits and reducing financial risk.

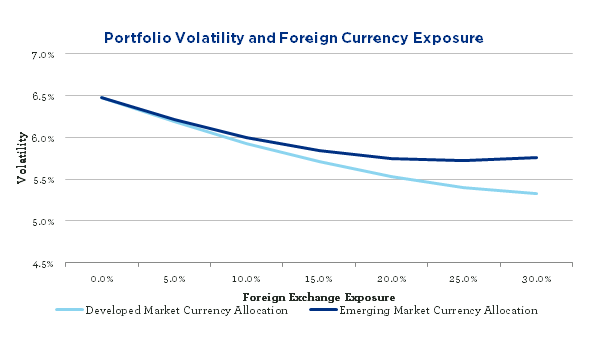

As demonstrated by the below chart, adding developed market foreign currency reduced the total fund risk and indeed for a reasonably large exposure there is a reduction in volatility.

Source: Perpetual, Bloomberg. Both live and back tested data has been used for the Diversified Real Return Fund. Results are for 31/12/1987 to 30/06/2013. Developed and emerging market currency baskets approximate the foreign currency exposures of the MSCI World ex Australia and MSCI Emerging Markets.

Another reason of the need of currency diversification from your home currency is when you think the economy of the country is mismanaged, natural resources are not maximized and utilized effectively and efficiently, high debts, corruptions are rampant and the favoritism and discrimination policies practiced by the ruling elites, then it is a high time for you to look into the need for home currency diversification in order to leverage and spread the investment risk across.

Adding hard currency into your investment portfolio is one of the option, a portfolio diversification strategy in which securities are purchased in various foreign currency denominations for purposes of minimizing foreign exchange risk, increasing global exposure, and capitalizing on exchange rate disparities is also highly sought by many investors to reduce risk and maximize portfolio return.

Which currency is the World Global Currency or Developed Market Currency?

In the foreign exchange market and international finance, a world currency or global currency refers to a currency that is transacted internationally, with no set borders. In this respect, the US Dollar and the Euro are by far the most used currencies in terms of global reserves as well as for trade and commodities settlement due.

The US dollar is still the world's reserve currency. In many places from China to Africa to South-East Asia currencies are strongly linked to the greenback. However, a third currency set to challenge US Dollar and Euro dominance as global currency is Chinese Yuan Renminbi (RMB), the official currency of People's Republic of China. China is set to continue its' call for a global currency to replace the dominant dollar and it's showing a growing assertiveness on revamping the world economy.

The establishment of Asia Infrastructure Investment Bank (AIIB) lead by China which attracts 57 founding members around the world including U.S.'s key allies like Australia, Britain, Korea, Canada is set to challenge and shake up the traditional American-led global financial order.

After all the fuss by U.S. and the reality is despite their constant lobbied against the establishment of China-led New AIIB from the start, and to the surprise and embarrassment of the Obama administration, the list of participating nations includes nearly every major economy, except for the U.S. and Japan is in fact a wake-up call for Washington.

Slated to start operations this year, the bank is expected to have $100 billion in capital, which properly borrowed against could underpin some $1.3 trillion in financing. The bank fits in nicely with Beijing’s aspirations for a more internationalized yuan(RMB) and also fulfills the continent’s need for greater investment in infrastructure: The Asian Development Bank estimates Asia will require some $8 trillion in investment by 2020, or face “negative consequences on economic growth.”

Another trend is the accumulation of "Gold" by China's Central Bank in recent years is yet another strong signal to international communities that China's ambition and desire to spread the usage of the Chinese Yuan Renminbi as a reserve currency, requiring them to take steps towards legitimizing the yuan for trade and accumulating gold reserves is one of these steps.

According to an industry expert, China’s secretive central bank may have stocked up heavily on gold in the past few years, and might own about 2,710 tons as of the end of 2013.

Precious metals expert and gold bug Jeff Nichols, a managing director of the American Precious Metals Advisors, wrote that much of this reported increase in holdings came from domestic Chinese mine production and secondary supply, which involves scrap or recycling gold.

According to Nichols’ sources, the Peoples' Bank of China (PBOC) bought 654 metric tons of gold from 2009 to 2011, 388 tons in 2012, and more than 622 tons in 2013. There is no recent official data about Chinese central bank gold holdings, as the institution last announced its gold holdings in April 2009, at 1,054 tons and this is the same amount of gold reported by World Gold Council as at Mar 2015.

There is a prediction that “By the end of Obama's second term as President, The Central Bank of China will publicly announce that they have an amount of gold in reserve that is greater than Germany's.” Germany is currently the 2nd biggest gold holding country with total holding of 3,383.4 tonnes as at Mar 2015.

Besides USD, EUR and RMB, others currencies worth to take a closer look and review are SGD, AUD and CHF.

Below are some charts on the performance of Ringgit Malaysia against major currencies and neighboring currencies for the last decade.

MYR per 1 USD (U.S. Dollar)

21 May 2005 00:00 UTC - 18 May 2015 04:57 UTC

USD/MYR close:3.57169 low:2.93700 high:3.83565

MYR per 1 EUR (Euro)

21 May 2005 00:00 UTC - 18 May 2015 04:59 UTC

EUR/MYR close:4.08401 low:3.80710 high:5.19570

MYR per 1 GBP (British Pound)

21 May 2005 00:00 UTC - 18 May 2015 05:01 UTC

GBP/MYR close:5.61178 low:4.54438 high:7.13955

MYR per 1 AUD (Australian Dollar)

21 May 2005 00:00 UTC - 18 May 2015 05:03 UTC

AUD/MYR close:2.86193 low:2.18194 high:3.31540

MYR per 1 CHF (Swiss Franc)

21 May 2005 00:00 UTC - 18 May 2015 05:06 UTC

CHF/MYR close:3.89188 low:2.74274 high:4.20138

MYR per 1 CAD (Canadian Dollar)

21 May 2005 00:00 UTC - 18 May 2015 05:08 UTC

CAD/MYR close:2.96659 low:2.77911 high:3.63103

MYR per 1 CNY (Chinese Yuan Renminbi)

21 May 2005 00:00 UTC - 18 May 2015 05:11 UTC

CNY/MYR close:0.57556 low:0.43368 high:0.59941

MYR per 1 INR (Indian Rupee)

21 May 2005 00:00 UTC - 18 May 2015 05:13 UTC

INR/MYR close:0.05619 low:0.04825 high:0.08827

MYR per 1 SGD (Singapore Dollar)

21 May 2005 00:00 UTC - 18 May 2015 05:16 UTC

SGD/MYR close:2.70105 low:2.02534 high:2.71833

MYR per 1 IDR (Indonesian Rupiah)

21 May 2005 00:00 UTC - 18 May 2015 05:18 UTC

IDR/MYR close:0.00027 low:0.00027 high:0.00042

MYR per 1 THB

21 May 2005 00:00 UTC - 18 May 2015 05:23 UTC

THB/MYR close:0.10666 low:0.08975 high:0.11662

No comments:

Post a Comment